The start.

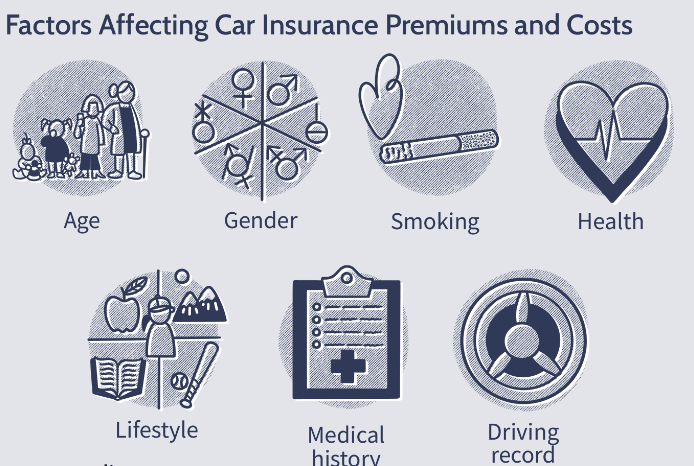

A few variables might make the cost of insurance go up or down. You can better manage your money and get the finest coverage for your needs if you know what goes into these fees. This book will go into great depth on the most essential elements that determine the price of insurance. It will provide you the knowledge you need to make sensible choices.

Things about you that affect the cost of your insurance

Your insurance costs may be greatly affected by a variety of personal qualities.

Age and Gender: For instance, younger drivers may have to pay extra for vehicle insurance since they don’t have a lot of experience. Older people may also have to pay more for health insurance since they are more likely to become ill.

Gender: Statistically, men and women may have different amounts of risk. For example, young guys who drive are more likely to get into accidents, which might make their vehicle insurance cost higher.

A past of health and medical issues

Current Health Status: The price of your health insurance relies on how healthy you are right now. If you have a long-term illness or a history of major health issues, your premiums may go higher.

Your family’s medical history might also affect your rates, particularly for life and health insurance, since it could suggest that you are more likely to have health difficulties in the future.

Job

Job Risk: Jobs that are seen to be dangerous, such building things or fighting fires, may cost extra for life, health, and disability insurance. But jobs that aren’t as perilous could have lower rates.

Things that are solely in the policy

The amount you have to pay each month will also depend on what your insurance covers.

Type of Coverage

Comprehensive vs. Basic: Comprehensive coverage costs more in premiums than basic coverage, but it gives you greater protection.

Amount of Coverage: Policies with larger coverage limits normally cost more since the insurance company may have to pay out more money.

The length of the policy

Short-Term vs. Long-Term: Plans that last a shorter time may cost more since they need to be renewed more regularly and the conditions of coverage may change.

Copayments and Deductibles

Higher Deductibles: If you choose a higher deductible, your premium may go down since you are taking on more risk if you make a claim.

Things that may go wrong

Your risk profile has a big effect on how much you spend for insurance.

Your record as a driver

Accidents and violations: If you’ve been into a lot of accidents or broken the law while driving, your car insurance premiums may go up since they suggest that you’re more likely to submit a claim in the future.

Your Credit Score

Insurance companies usually look at your credit score to see how hazardous you are. Your costs can be lower if your credit score is higher. Your costs may be higher if your score is lower.

Making Choices in Life

If you smoke and drink too much, your health and life insurance premiums will go up since these things are hazardous for your health.

Where

Your location may determine how much you spend for insurance. Your premiums may be higher if you reside in a place where there is a lot of crime, natural disasters, or traffic.

History of Claims

The biggest issue that impacts how much you spend for insurance is your claims history.

How frequently you make claims

Multiple Claims: If you’ve made more than one claim in the past, your insurance company may see you as a bigger risk and hike your premiums.

Different types of claims

The kind of claims you make might change how much your insurance costs. For example, little claims that happen a lot and major claims that happen just once in a while. If there are a lot of small claims, it might indicate that more claims are likely to happen in the future.

Discounts and bonuses

You may be able to get reduced insurance rates by using discounts and benefits.

Making policies work together

Multi-Policy savings: You might save a lot of money if you purchase more than one policy from the same firm, including home and car insurance.

Discounts for Not Making Claims

Discounts for Not Making Claims: A lot of insurance companies provide their clients discounts if they haven’t filed a claim in a certain length of time.

Loyal customers get discounts

Long-Term Customers: If you remain with the same insurance carrier for a long period, you may be able to receive lower rates since you’re loyal.

Things that affect the economy and the market

The policyholder may not be able to control the cost of insurance, which might go up or down.

Changes in the Market for Insurance Competition: The number of various insurance companies in the market might affect the cost of premiums. When there is more competition, prices usually go down.

The state of the economy

Inflation: When inflation happens, claims may cost more. This implies that insurance companies have to raise rates to cover these extra costs.

Changes to the law

The cost of premiums might go up or down if the laws and regulations of insurance change. Costs can go rise, for example, if you need more coverage.

How to Find Cheaper Insurance

Here are some ways to save money on your insurance:

Improve Your Credit Score

To keep your credit score good, you need to be wise with your money by paying your bills on time and keeping your debt under control. This might imply that rates for insurance go down.

Keep your record clean.

Don’t violate the law or get into accidents if you want to keep your auto insurance costs low. Being cautious while you drive might help you save money on insurance.

Pick Higher Deductibles

If you pick a greater deductible, your premium can go down. If you need to, make sure you have enough money saved up to cover the deductible.

Get the best bargains

seek Quotes: You should always seek quotes from more than one insurance company and compare them to get the best prices and coverage options.

Take advantage of discounts

To get reduced rates, talk to your insurance carrier about the discounts they offer, such as multi-policy, no-claims, and loyalty discounts.

Questions and Answers

Does the kind of job I perform have an affect on how much my insurance costs?

Yes, those who work in dangerous occupations may have to pay more for life, health, and disability insurance because they are more likely to be harmed or ill.

How does my history of driving effect how much I have to pay for auto insurance?

Your auto insurance premiums will go up if you have a history of accidents or traffic violations and then submit a claim.

Why do insurance companies check my credit score before they give me a quote?

Insurance firms look at people’s credit scores to see how likely they are to submit a claim. A higher credit score means you’re careful with your money and could earn lower charges.

What are some common discounts that might help me save money on my insurance?

Some popular discounts include for having more than one policy, not making any claims, and being a long-time loyal customer.

How does the economy impact the price of insurance?

Inflation and other economic factors might make claims cost more. Insurance firms raise their rates to cover these costs.

To sum up

If you know what impacts your insurance prices, you can make informed decisions and save money. You may be able to get a better idea of the insurance market if you think about your particular situation, the details of your policy, the risks involved, your claims history, and the health of the market. You may cut your rates even further by lowering your risk profile and taking advantage of discounts that are offered. Keep up with the news, look into your options, and choose the coverage that works best for you.