- A step-by-step guide to figuring out how to file a home insurance claim

It might be hard to know how to file a claim for home insurance. Many people don’t know where to start, what to do, or how to make sure the end is fair. You need to know how the claims process works in order to get the money you need to repair or replace damaged property.

If homeowners have the right knowledge, they may feel confident about this process. Knowing how to document damage, communicate to your insurance carrier, and understand what your policy covers are all important parts of making a successful claim. Learning these steps may help people feel less stressed and get things done faster.

Key Points

Homeowners need to accurately document the damage in order to file a successful claim.

Knowing what your insurance covers could help you figure out what to expect.

It’s crucial to communicate to insurers openly so that problems may be solved fast.

Getting to Know What Home Insurance CoversThere might be a lot of discrepancies in the coverage that house insurance offers. Homeowners should know what sorts of coverage are out there, what each policy’s limits are, and what their personal insurance papers indicate.

Different types of coverage

A lot of items are covered by most house insurance plans. The most common types are:

Dwelling Coverage: This kind of insurance covers the roof and walls of a home against damage caused by storms or fires.

Personal Property Coverage: This insurance will compensate for your furnishings or electronics if they become lost or ruined.

Liability coverage protects you if someone gets harmed on your property. It could also cover the cost of legal bills.

Extra Living Expenses: This helps pay for a place to stay while your residence is being repaired after a covered loss.Each kind of coverage has a particular function to accomplish to safeguard the homeowner’s investment and loss.

Limits on Coverage

The coverage limitations tell you how much the insurance company will pay for a claim. Homeowners should recognize two crucial things:

Policy Limits: This is the maximum that may be claimed for damages. The most the insurance company will pay to repair or rebuild the home is $300,000.

Sub-limits: Some items may not be able to go as high as others. For example, you may only be able to insure jewelry or devices that are worth a lot of money up to a certain amount unless you get extra coverage.When you decide how much insurance to buy, it’s vitally essential to know these limits.

How to Read Your Policy

It is crucial to read and understand your home insurance policy. Some key aspects are:

Page of Declarations: This page presents a summary of the policy, including the types of coverage, the limits, and the premiums.

Things that the insurance doesn’t cover are called exclusions. For example, damage from floods or earthquakes. Homeowners may avoid surprises by learning what their insurance doesn’t cover.

Before insurance begins to pay, the homeowner needs to pay a certain sum called a deductible. Most of the time, a higher deductible means lower rates.Checking the policy regularly makes sure that it still meets the needs of the homeowner.

How to Get Through the Claims Process

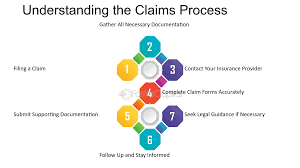

The claims process may seem complicated, but it may be easier if you know what to do. This section tells you how to initiate a claim, what to expect throughout the review, how to make improvements, how to handle conflicts, and how to be compensated.

Beginning a Claim

Call the insurance company first. You can usually do this over the phone or online. The individual who has the insurance should have their policy number close by.

Most companies provide a phone number for claims. You may obtain assistance with this at any time of day or night.

After you make a claim, the company will assign an adjuster to check into it. This person will assist the policyholder decide what to do next.

You need to jot down the date and time of the call. It helps to keep track of all the messages sent throughout the procedure.

Keeping Records and Evaluating

After you make a claim, an adjuster will come to the property. They will check out the damage and acquire further details.

The policyholder should be ready by getting documentation such

Photos of the damage

Receipts for repairs

Any news from the police or fire departmentThese documents support the claim and help the adjuster understand what’s going on.

Being present for the examination could provide you an opportunity to speak about the damage. The process will go more smoothly if the adjuster has more information.

Changes to Claims

Adjusters usually make initial decisions, but they may amend the claim if they uncover new proof. They go over every the documents that the policyholder puts in.

There are a number of reasons why changes could happen, such as:

During the review, new facts came to light.

Changes in how much repairs cost

News about losses that weren’t documented at initiallyPolicyholders may ask their adjusters about changes.

It’s really vital that kids ask questions if they don’t comprehend anything. Clear communication may assist minimize misunderstandings and make sure that all information is considered.

Resolving Disagreements

There are times when there are arguments throughout the claims process. This might happen if the policyholder doesn’t agree with the adjuster’s decision.

In these cases, he or she should go over the claim details. It is vitally crucial to know why the adjuster made the choice.

If the disagreement doesn’t go away, the policyholder might seek for a second opinion. Most insurance companies have mechanisms to review claims.

A consumer advocate or a lawyer might also assist you out. It’s really crucial to be calm and organized throughout disagreements.

Getting Paid

After the claim is approved, the insured will be reimbursed. The amount of the reimbursement depends on how much damage was done and what the insurance covers.

Most of the time, insurance companies provide money directly to the homeowner. It’s not uncommon for contractors to get compensated to fix things that require fixing.

Pay close attention to the payment paperwork. If you know what is covered and what the deductibles are, it will help clear up any confusion.

Call the claims department if your payments are late. Quick follow-up could help issues be fixed faster.

Also read:

The Benefits of Indexed Universal Life Insurance

How to get the best insurance agent and save your insurance costs

How to Look at Different Life Insurance Policies

The Most Important Insurance Trends to Keep an Eye on in 2024