- A Clear Guide to Your Costs: How to Understand Insurance Premiums and Deductibles

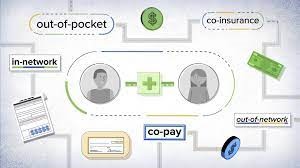

Insurance may be hard to understand, especially when it comes to premiums and deductibles. The deductible is the amount of money that a policyholder needs to spend out of their own pocket before the insurance kicks in. Premiums are the payments that a policyholder pays on a monthly basis to keep their coverage. You need to know how these two elements work together in order to choose the right policy.

The deductibles and premiums for various plans might be quite diverse, which can have a large effect on a person’s budget. If people grasp how these rates operate together, they can make better decisions about their insurance options. This information helps you find a good balance between your monthly payments and any additional costs you may have to pay out of pocket when you make a claim.

You don’t have to work hard to learn how to cope with insurance. With the right information, anybody can confidently decide out what they need and choose a policy that fits their budget and protection requirements.

Key Points

Before your insurance kicks in, you have to pay your deductible.

Premiums are the monthly payments you make to retain your coverage.

To manage insurance properly, you need to discover a way to balance these costs.

What Deductibles Are and How They Affect YouDeductibles are a very significant aspect of insurance plans because they tell the policyholder how much they have to pay when they file a claim. They also change how much the premiums cost in total. It is wise to know these facts.

Things You Should Know About Insurance Deductibles

A deductible is the amount of money that a policyholder needs to pay before the insurance company would pay for anything. If someone has a $500 deductible and files a claim for $2,000, they will pay the first $500. After then, the insurance company covers the final $1,500.

varying insurance have varying amounts that you have to pay out of pocket. Some plans have low deductibles, which means the insurance company needs to pay more straight away. Some have high deductibles, which might lower the cost of monthly premiums. Choosing the right deductible is vital because it will help you keep your monthly payments and out-of-pocket costs during claims under control.

How Deductibles Change the Amount of Money You Get for Claims

The deductible affects how much money someone receives during a claim. People with higher deductibles may have to pay for more items themselves. This might entail paying more when a claim is made.

The insurance company pays $2,000 after the deductible if it costs $3,000 to repair a car and the deductible is $1,000. If the deductible is $2,000, the insurance company will only pay $1,000. This link helps policyholders think hard about how much risk they can take and how many claims they have filed in the past.

How deductibles and premiums work together

Most of the time, premiums and deductibles are not the same. In most cases, bigger deductibles indicate lower premium pricing. This means that clients could save money every month, but they should be ready to pay more out of their own pockets should they make a claim.

On the other hand, lower deductibles frequently entail higher premiums. This might be useful for those who wish to keep their costs low when they make a claim. Understanding how this link works helps customers get a policy that fits their budget and risk level.

How much premiums are

Premiums are the amounts of money you pay for insurance. There are a lot of elements that determine premium levels, and knowing what they are may help customers save money.

Things that change the cost of insurance

There are a lot of major factors that impact the cost of insurance premiums. These are:

kind of coverage: The price of insurance changes based on the type of coverage. For example, health insurance is often more costly than homeowner’s insurance.

Deductibles: Usually, the higher the deductible, the lower the premium. This means that the person who holds the coverage needs to pay extra out of their own pocket before the insurance kicks in.

Personal Information: Your age, gender, and where you reside may all affect how much you pay for insurance. People under 25 may have to pay more for auto insurance, and homeowners in areas that are vulnerable to flood may have to pay more.

Claims History: Your premiums may go higher if you have a lot of claims. This is a larger risk for insurance providers.

Credit Score: Sometimes, having a better credit score will help you save money on insurance. People with good credit may be seen as more responsible by insurance providers.

Ways to Keep the Cost of Premiums DownThere are a few things you can do to assist keep your insurance prices low. These are:

Shop Around: You may be able to get cheaper prices by getting estimates from more than one insurance company. Getting a number of quotes could help you save money.

Increase Your Deductibles: Choosing a higher deductible may lower the cost of your premiums. It’s also important to make sure that the higher deductible is fair if you have to submit a claim.

Policies in a bundle: Getting more than one kind of insurance from the same company can often save you money. For example, you may be able to save money by getting both car and home insurance at the same time.

Get Discounts: Many insurance companies provide discounts to those who drive responsibly, serve in the military, or don’t submit any claims. Thinking about these options could help you get lower rates.

Look at Policies Often: Keeping track of insurance information and changes in your situation may help keep costs reasonable. Getting updates regularly can help you receive better rates.Read Also:

How to Choose the Best Auto Insurance Company

How to Understand Your Health Insurance Plan

How Life Insurance Can Help Families

How to Get Lower Car Insurance Rates and Understand Flood Insurance