- Helpful advice on how to save money on your insurance

Many individuals desire to save money on insurance, but it may not be easy to do. You may save a lot of money on your insurance in a number of ways. Anyone can save money on insurance by learning how rates are established and applying sensible strategies.

Many people don’t know that there are easy ways to lower the cost of their insurance. You may be able to save a lot of money by following these strategies, such as looking over your coverage choices or combining several forms of insurance. In the long term, it could be helpful to take the time to check into these choices.

Taking the initiative with your insurance may help you get greater coverage for less money. This blog article will show you the best strategies to save money on insurance without losing the coverage you need.

Important Points

You need to know how premiums operate if you want to save money on insurance.

These simple methods might help you save a lot of money on your insurance.

You may be able to save money by checking and changing your coverage on a frequent basis.

How to Find Out What Your Insurance Premiums AreInsurance premiums are the amounts you pay to an insurance company to get coverage. There are a variety of things that might influence how much someone pays. Knowing these things may help you identify strategies to minimize your insurance costs.

Things that make premiums more or less expensive

There are a few important things that affect how much insurance premiums cost.

Age and Gender: Car insurance is usually more costly for younger drivers since they are seen as more prone to get into accidents. Gender might also be a factor, as studies suggest that males usually pay more.

Your history of driving or making claims: If you have a good driving record, your rates can go down. Your premiums may go up if you have had accidents or made claims in the past.

Location: The rates depend on where a person lives. Your premiums may be higher if you reside in a place with a lot of crime or a history of natural catastrophes.

Type of Coverage: Basic coverage are often less expensive than full insurance. More coverage means more rates, but it also means better protection.

Credit Score: Many insurance companies utilize credit ratings to figure out how risky a person is. A higher score typically means cheaper rates.

What Deductibles AreDeductibles are the amount of money a person has to spend out of pocket before their insurance kicks in. They may have a big effect on how much you pay each month.

greater deductibles: If you choose a greater deductible, your rates will usually be cheaper. This implies that the individual who is insured pays less each month, but they have to pay more when they file a claim.

If you have a lower deductible, you’ll have to pay more each month but less when you make a claim.

Choosing the Right Thing: It’s important to find a good balance between the deductible and the premiums. Everyone should look at their own finances to see which choice is best for them.People may be able to make smart choices regarding their insurance coverage and prices if they take the time to think about these things.

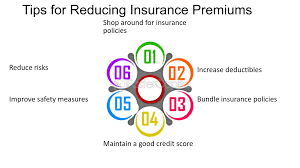

How to Pay Less for Insurance

There are a lot of clever strategies to cut down on the cost of your insurance. If people take the initiative and make smart decisions, they might save a lot of money. Here are some things you may want to think about.

Getting the Best Deals

It’s really important to compare insurance costs. Prices might be quite different from one insurance company to the other. obtain quotations from more than one company to obtain the best pricing.

This approach could be simplified with the help of internet comparing tools. Customers may rapidly compare various pricing and coverage choices using these tools.

When you ask for estimates, be sure to provide each insurance company the identical information. This makes sure that the comparisons are correct and helps you choose the best one.

Guidelines for Bundling

Putting together a few insurance plans might save you a lot of money. A lot of businesses provide their consumers a discount when they purchase more than one plan, like car and house insurance.

For instance, a consumer who combines their plans can pay 10% to 25% less for their coverage. This not only cuts prices, but it also makes it easier to remember what insurance you need.

It’s smart to compare the price of a bundle to the price of each item of insurance before you buy it. This helps make sure that the savings from bundling are real and worth it.

How to Keep Your Credit Score Up

The cost of insurance may depend a lot on a person’s credit score. Insurance companies routinely utilize credit information to set prices. Most of the time, a better credit score means cheaper rates.

People should pay their payments on time and keep their credit card balances low to keep their credit score high. You should also check your credit reports often to make sure they are correct.

People may be able to save hundreds of dollars on insurance over time by raising their credit score.

How to Make the Most of Discounts

A lot of insurance firms provide their consumers discounts that they may not know about. These may be prizes for doing well in school, driving safely, or having security systems in your house or automobile.

Customers should contact their insurance companies to see if they may obtain any reductions. Keeping track of who can receive discounts might help them save the most money possible.

You could also be able to save more money over time by keeping up with any changes to discount schemes.

Changing the restrictions on coverage

Changing the limitations on your coverage might make a big difference in how much you pay for insurance. People may check their current insurance to see what they need to be covered.

You may cut your rates by choosing a larger deductible, but you’ll have to pay more out of pocket when you make a claim. Finding a balance that works for everyone is really important.

If you take the time to think about what you need, you may be able to save money on your insurance without sacrificing important coverage.

Look over your policies once a year.

You should go over your insurance coverage every so often. People’s needs and wants may alter throughout time. An yearly evaluation could help you find ways to save expenses or make changes that need to be made.

It’s helpful to look at both old and new plans that are available throughout the evaluation. This makes sure that people are receiving the greatest deals.

You should also look for any modifications in coverage, restrictions, or exclusions. Taking charge of your insurance may help you get better prices and coverage that suits your needs over time.

You should also look at:

How to Look at Different Types of Life Insurance Plans Understanding Home Insurance Riders

How to Get Cheap Health Insurance

Why Freelancers Should Have Insurance

The Benefits of Having Full Coverage on Your Car