- A Simple Guide to Your Health Insurance: What It Covers, How Much It Costs, and What It Does

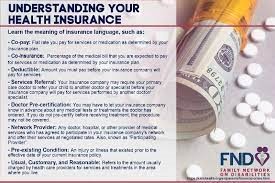

A lot of folks don’t know what their health insurance covers. You should know what your health insurance policy covers so that you don’t have to pay for medical care that you didn’t anticipate and can get the most out of your benefits. If people know certain important terms and phrases, they may be able to get the treatment they need and better understand their coverage alternatives.

First, it’s helpful to look at the parts of a policy. This means you should be aware of what your plan covers, how much your deductible is, and how coinsurance and copayments work. Taking care of your health care is simpler and less stressful when you know these facts.

You can make better choices regarding your health care if you know about health insurance. Learning about the policy may help everyone feel safer and more able to deal with medical problems.

Main Points

If you know what your insurance coverage covers, you may be able to avoid unnecessary fees.

If you know what your insurance covers, you may be able to make better decisions about your health care.

Knowing what to expect makes going to the doctor less stressful.

Getting to Know the Basics of PolicyIt might be hard to know what health insurance covers. People can make smart choices regarding their coverage if they understand the essentials. You should pay attention to the different kinds of plans, how to read the summary of benefits, the main charges, and the coverage for preventive care.

There are a lot of various kinds of health insurance plans.

There are a number of different kinds of health insurance programs. There are several methods to get treatment and benefits for each plan.

People who have a Health Maintenance Organization (HMO) plan must go to physicians who are part of the network. Your primary care physician (PCP) is in charge of all of your care. Most of the time, experts require references.

Preferred Provider Organization (PPO): This plan lets you choose your providers more freely. Members may go to any doctor, but it’s cheaper to visit one in their network.

An Exclusive Provider Organization (EPO) is like a PPO, except it only pays for care in the network in an emergency.

Point of Service (POS): This plan has parts of both HMO and PPO. Members may pick between providers who are in their network and those who aren’t.

Looking at the Summary of BenefitsA Summary of Benefits and Coverage (SBC) is included with every health insurance plan. This paper makes important information easy to understand.

The SBC normally has:

Covered services: What kinds of care and treatments are provided.

Cost-sharing: The member’s part of the expenditures, such coinsurance and copayments.

Limits: Any limits on the advantages for certain services.People who know what the SBC is may have a better notion of what to anticipate when they use their insurance. This is a simple method to learn about coverage and prices.

Knowing how much your premiums, deductibles, and out-of-pocket maximums are

It’s important to know the main charges of a health plan. Premiums, deductibles, and the maximum you may spend out of cash are the three most important things to know.

Premium: The amount you pay each month for your insurance. This is the price you pay, no matter how much healthcare you use.

Deductible: The amount you have to pay before the insurance company will pay for treatment. For instance, if the deductible is $1,000, the user must pay this amount out of their own cash before they may start getting benefits.

Out of Pocket Maximum: The most money someone can spend in a year. Once the maximum amount is reached, the insurance pays for everything.These words assist individuals understand how much they can afford to pay for health care.

Coverage for Services That Fix Issues

Preventive care is important for keeping people healthy and finding problems early. Most health plans cover these treatments for their members.

Here are some typical services that might help you avoid issues:

Yearly checkups: Going to the doctor every year to make sure you’re healthy.

Vaccinations are shots that keep you from becoming sick.

Screenings are tests that search for issues like diabetes and high blood pressure.People are more likely to get medical treatment if they know about the many types of preventative care that are available. This might be good for your health and save you money in the long run.

Taking care of your health care

To remain healthy, you need to choose the correct doctors, know what your insurance covers, and file claims the right manner. You should learn how to go to these areas so you can make the most of health services.

Choosing Providers in Your Network

The insurance firm has deals with physicians, hospitals, and clinics that are part of its network. Usually, utilizing these providers is cheaper than going outside of the network.

Pre-Authorizations: Before certain surgeries or treatments may proceed, you need to receive authorization. Before the service can place, the insurance company needs to give the green light. The doctor usually puts in the request, but patients should check to see whether they need to get permission before getting therapy.

If you don’t acquire a referral or pre-authorization, you could have to pay more or have claims that are denied.

How to Deal with Claims and Appeals

You need to know how to handle claims and appeals to make sure you have coverage. A claim is a request for payment that a health care provider submits to the insurance company.

Check Claims: After getting treatment, patients should go over their Explanation of Benefits (EOB). This document shows how much the patient still owes and how much the insurance company paid.

File Appeals: File Appeals: If a patient’s claim is denied, they have the right to appeal. This method generally involves turning in paperwork that shows the treatment is medically essential.

Keep an eye on things: Keep a record of all of your interactions with the insurance company, such as letters and phone calls. This documentation is highly crucial for an appeal.People may be able to use their coverage better and prevent unexpected costs if they understand their claims properly.

Changing or renewing your policy

When you change or renew your health insurance, it’s important to consider carefully. Patients should be aware of critical times and decisions.

During the open enrollment period, you may usually change your insurance. It’s really vital to look at all the different coverage options and compare plans.

Life changes: You may be able to sign up for a special enrollment period if you get married, start a new job, or move. These modifications might impact the coverage you need.

Review of Coverage: Patients should check to determine whether their current doctors are still in-network and if their fees or benefits have changed when they renew.Being proactive about changes to policies may help you maintain obtaining the health care you need.

Also check out:

Why Freelancers Should Get Insurance

The Best Tips for Choosing Travel Insurance

The Pros and Cons of Whole Life Insurance

Getting to Know Flood Insurance

How to Choose the Right Health Insurance Plan