- A Full Guide to Making Smart Decisions When You Compare Life Insurance Policies

It might be challenging to choose the right life insurance policy. There are a lot of options, so it’s important to know what to look for to get the best one for your needs. They need to look at the various levels of coverage, pricing, and insurance features to make a good pick.

If you know the basics, you may start to look at and evaluate different life insurance policies. This information helps you understand the distinctions between term life, whole life, and universal life insurance, which makes it simpler to compare them. By focusing on the most critical components, they may be able to better choose which insurance policy meets their financial goals and keeps their loved ones safe.

When you set up your life insurance, it’s easier to make good choices if you know the details of each policy. This article will help readers understand the most crucial elements to keep in mind while comparing insurance and making a decision.

Key Points

Different life insurance policies cover different things, cost different amounts, and provide different advantages.

It’s easy to evaluate your options when you know the basics.

You can protect your money better by looking at several programs.

Getting to Know the Basics of Life InsuranceLife insurance is a way to make sure that your family will have money when you die. You need to know the most significant terms and types of insurance in order to make sensible choices.

Different Types of Life Insurance

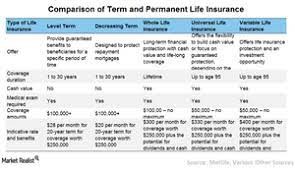

There are two main types of life insurance: term and whole life.

Term life insurance protects you for a certain length of time, generally between 10 and 30 years. It usually costs less than permanent insurance. If the insured person dies within this term, the beneficiaries obtain a death benefit.

As long as you keep paying the premiums, permanent life insurance will cover you for the rest of your life. This includes whole life and universal life insurance. With whole life insurance, you pay a predetermined amount each month and get a guaranteed death benefit. Universal life allows you adjust your death benefits and premium payments whenever you choose, which gives you more flexibility.

Finding Out What Kind of Coverage You Need

When you choose a life insurance policy, it’s important to know how much coverage you need. This might fluctuate from person to person. Things to ponder about are:

Income at the moment: How much money does the family need to get by?

Do you still owe money on any loans or mortgages?

The costs of going to school are: Do your kids need money for college or other kinds of school?

How much does the family spend on living costs each month?These needs will help you figure out how much insurance coverage you need.

Term Insurance vs. Permanent Insurance

There are different times when you should utilize term and permanent insurance.

People who only need insurance for a limited time, such while they are raising kids or paying off a mortgage, should get term insurance. It typically has lower premiums, which is good for your pocketbook.

Permanent insurance is for those who wish to be covered for the rest of their life. It also increases in cash worth over time, which you may borrow against if you need to. The choice between these groups depends on the family’s needs and the person’s financial goals.

People can make better decisions regarding life insurance when they grasp these basic facts.

Comparing and looking at policies

When you buy for life insurance, you should evaluate providers, pricing, and benefits. You should also know what isn’t covered and look at alternative options for coverage. This organized approach of doing things makes it simpler to find the right policy for everyone.

Looking at several insurance providers

You need to be able to trust the insurance provider you select. Check out the company’s background, such its history and how well-known it is. Check out ratings from businesses like A.M. Best or Standard & Poor’s to evaluate how financially stable the business is.

You may also learn from user reviews. Having an excellent customer support team may assist when you make a claim. Look for insurance firms that have a long reputation of rapidly paying out claims.

Comparing premiums and benefits side by side

The price of premiums might be quite variable from one insurance to the next. You should think about both the costs and the benefits. Take a look at a comparison table to see:

The cost of policies

How much coverage is there? Benefits for deathList what each insurance policy covers. This helps you choose the best insurance for your money. Some plans hike rates when you reach a specific age, so consider about how your premiums could change over time.

Knowing what your coverage does and doesn’t cover

Life insurance plans cover certain things and don’t cover others. Exclusions are situations when the coverage doesn’t pay. Some typical things that aren’t covered include killing yourself in the first two years and doing activities that are harmful.

It is very important to read the tiny print. You may avoid shocks later on if you know about these limits now. Depending on your age or condition, there may also be restrictions on how much coverage you may obtain.

Going over riders and other choices for coverage

Riders are added things that can improve a fundamental policy. They provide you additional choices for how to personalize your coverage. Some common riders are:

Accidental Death Benefit: This benefit pays out additional money if the covered individual dies in an accident.

If the individual who is covered becomes unable to work, they don’t have to pay premiums.You could feel more free if you think about these options. You can find out how much a rider is worth by looking at how much they cost. Think about if the additional coverage meets your needs and future aspirations. This makes sure that the coverage you choose protects you sufficiently.

Also Read:

Why individuals who have dangerous occupations require insurance

How to Find Affordable Health Insurance

How to Figure Out Insurance Premiums and Deductibles

The Benefits of Life Insurance for Families

How to Choose the Right Health Insurance Plan