- A Full Guide on Choosing the Right Insurance for You

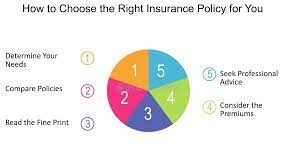

It might be challenging to choose the right insurance. It’s important to think about what you need and look at a lot of options to choose the best one. There are a lot of different types of insurance, and understanding which ones to get for various situations may help you save time and money.

Many people may not know how crucial it is to choose an insurance provider you can trust. They should consider about how effectively they serve clients, how fast they process claims, and how much coverage their plans provide. Making a good decision might help keep you safe and offer you peace of mind.

Getting the right insurance doesn’t have to be tricky. If people know what to look for, they may pick the coverage that fits their lifestyle and budget.

Key Points

Before you get insurance, think about what you need.

Check out suppliers to discover whether they are trustworthy and offer excellent customer service.

Make sure your plans cover enough.

Getting to Know the Basics of InsuranceInsurance is a way to protect your money. When people grasp the basics, they can make better choices. Here are some topics that are really essential to consider about.

Various Types of Insurance Policies

You may get a lot of different forms of insurance. Each kind has a different job and guards against different hazards. Some of the most common types are:

Health insurance provides for medical expenditures for injuries and illnesses.

Auto insurance pays for damage to automobiles and for accidents that happen.

Homeowners insurance covers damage to homes and personal property.

When the policyholder dies, life insurance pays money to their dependents.If people know what their options are, they can choose the right policy for their needs.

Considering a few different covering choices

When picking an insurance policy, it’s crucial to look over all the coverage options carefully. Each insurance policy offers a different level of protection. Here are some crucial things to consider about:

Before their coverage starts, the insured must pay the deductible.

Limits: The maximum amount of money that the insurance company will pay for a loss that is covered.

Exclusions are some situations or circumstances that the insurance does not cover.You can find out what is and isn’t covered by reading the fine print and asking questions.

Finding out what sort of coverage you need

People should think about their particular situation to decide what sort of insurance they need. This entails thinking about topics like:

Assets: The value of items that need to be protected.

Risks are things that may happen that would make you lose money.

Lifestyle: Things you do every day that might influence the kind of insurance you require.People may be able to figure out how much coverage they need by making a list of their priorities.

Choosing the Right Insurance Company

It’s really crucial to choose the right insurance provider. Choosing the right one may provide you better coverage and make your clients happy. Reputation, financial stability, premiums, benefits, terms, and customer service are all crucial things to think about.

Checking the provider’s reputation and how well they are doing financially

A client’s treatment may depend on how well-known the insurance company is. Check out reviews and ratings from well-known companies like A.M. Best, Moody’s, or Standard & Poor’s to evaluate how stable something is. You can trust someone who gets good reviews.

Having steady finances is also very crucial. You should seek for an insurance company that has strong financial ratings, which suggests it can pay your claims. Choose a provider that has a history of paying its invoices on schedule. This makes sure they will be there when a consumer needs them the most.

Comparing premiums and benefits side by side

The premiums are rather high. They might be quite diverse from one source to the next. To get the best pricing, customers should seek quotes from a number of different companies.

The price should be fair given the benefits. You may not be able to get the coverage you need with lower rates. Check out what each policy covers, including any limits or exclusions. Write out the most essential benefits to help you compare.

Monthly Premium for the Provider Main Benefits of Amount of Coverage

Provider A: $100; Provider B: $50,000; Provider B: $85 for accident forgiveness and $50,000 for the service. Free help on the side of the road

Reading the Terms and ConditionsThe terms and conditions might be different. Customers should read the conditions of the policy very carefully. Some of the most crucial items to look for are wait times, cancellation policies, and explicit exclusions.

Reading the small print is really crucial. There may be hidden expenses or restrictions in certain insurance policies that might hurt claims. Make sure your consumers know their rights, especially when it comes to altering or terminating their coverage.

How to Get Help and Make a Claim

People may be quite unhappy if the customer service is bad. Companies should provide consumers more than one way to get support, including via phone, email, or chat. Quick responses are necessary for any significant issues.

It should be straightforward to file a claim. When things are hard, it may be annoying. Find out how long it generally takes to process a claim and make sure that the provider has a simple way for you to file claims. A solid claims department can help customers when they are under a lot of stress.

Read Also:

The Most Important Things That Change Your Insurance Rates

What Insurance Does to Help You Get Ready for Emergencies

What Indexed Universal Life Insurance Can Do for You

Things You Should Know About Home Insurance Riders

Why freelancers should get insurance