Starting

There are so many insurance companies to select from that it could be hard to choose the right one. Insurance is an essential element of preparing your finances since it keeps you safe and provides you peace of mind when things go wrong. This article will help you choose the best insurance company by going over some crucial items to consider about, such what you need and comparing various companies and what they provide.

Knowing What Type of Insurance You Need

Before you can choose the right insurance provider, you need to know what kind of insurance you need and how much coverage you need.

Different types of insurance

People typically seek for various types of insurance, like:

Health insurance compensates for medical expenses and other health-related costs.

When cars become damaged or hurt, auto insurance pays for it.

Homeowners and renters insurance protects you against theft, damage to your property, and other costs.

If the policyholder dies, life insurance pays money to their beneficiaries.

If you can’t work because of an accident or illness, disability insurance will give you money.

Travel insurance protects you against difficulties that might happen while you are traveling, such having to cancel your vacation or becoming sick.

Figuring Out What Kind of Coverage You Need

To find out how much coverage you need, think about your particular situation. Things to think about are:

Dependents: The number of people who rely on your income or support.

Assets: The value of your possessions and real estate.

Liabilities: The debts and other money you still owe.

Things that put you at risk: your career, your way of life, and your health.

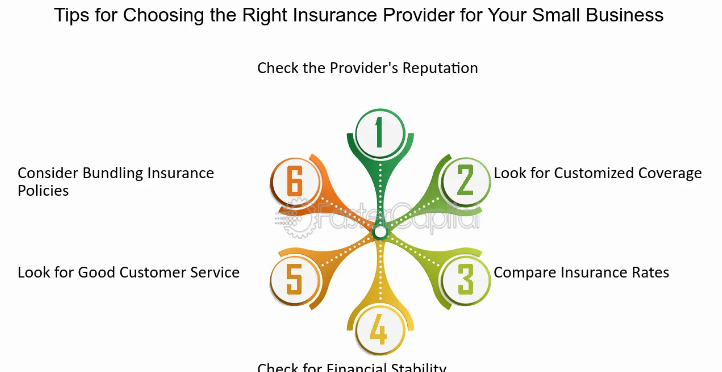

Searching for Possible Insurance Providers

After you know precisely what you need, the following step is to check into prospective insurance firms.

Reputation and Financial Health

Choose an insurance provider that is well-known and has a good financial history. You need to be confident that the company can pay claims when they come up.

To find out how financially reliable the supplier is, look at the ratings from companies like A.M. Best, Moody’s, and Standard & Poor’s.

Background of the Company: Consider how long the company has been around and how long it has been selling insurance.

Customer reviews and ratings

Customer reviews may tell you a lot about how dependable and excellent the service of an insurance business is.

Check out consumer reviews and ratings on sites like Yelp, Trustpilot, and the Better Business Bureau.

Look at the comments and reviews on the company’s social media pages to discover how they handle customers.

Different kinds of products that are available

A good insurance provider should offer a range of products that might meet your needs.

All kinds of coverage options: Check to see whether the provider has the right kind of insurance for you.

Policies that may be changed: Find vendors who allow you adjust their policies to fit your needs.

Comparing Different Insurance Quotes

After narrowing down your list of potential providers, compare their insurance quotations to get the best deal.

Learning About Premiums and Deductibles

The premium is the cost of the insurance, and the deductible is the amount you have to pay out of your own pocket before the insurance kicks in.

rates of Premiums: Check out the rates of premiums from different companies that provide the same level of coverage.

Deductibles: Check out the deductibles and see how they change the overall cost and coverage.

Looking at a few different coverage choices

Different insurance options are available. It’s crucial to look at the various kinds of coverage that different insurance providers offer.

Limits on Coverage: Check the highest sums that each insurance will pay out.

Policy Inclusions: Check to see that the policy covers all you need it to.

Thinking about more discounts and advantages

Many insurance companies provide additional benefits and discounts that might be quite useful.

When you buy a lot of plans from the same company, look for ways to save money.

Loyalty programs: Some firms provide discounts to customers who remain with them for a long period.

Promotions: Check for any discounts or special deals that are based on your profile.

Help and support for customers

positive customer service is highly vital for a positive insurance experience if you need to file a claim.

Easy to get in touch with and fast to reply

Check how simple it is to get in touch with the provider’s customer service and how soon they get back to you.

Ways to Get in contact: Make sure there is more than one way to get in contact with the provider, such as via phone, email, or live chat.

Response Time: Pick suppliers that are recognized for being helpful and getting back to you soon.

The Steps in Making a Claim

It should be easy and fast to file a claim.

Find out whether the provider provides a quick and clear manner to submit claims, either via an app or online.

Handling Claims: Check out how successfully the provider has handled disputes in the past.

Customers are happy

Customers’ happiness is a fantastic method to assess how well the service is overall.

Reports and Surveys: Look at reports and surveys from other organizations that look at how satisfied consumers are.

Suggestions and Referrals: Ask friends, family, and colleagues for ideas based on what they have done.

Checking out the Policy’s Terms and Conditions

Carefully read the terms and conditions of any insurance you are contemplating about.

Limitations and Exclusions

There are always things that an insurance policy doesn’t cover.

Know what the insurance doesn’t cover: Understand the exclusions.

Limitations on coverage: Be aware of what the coverage does not cover.

Conditions for canceling or renewing an insurance

Be aware of what the policy says regarding canceling and renewing.

Find out how and when the insurance renews and whether the premiums go higher.

Conditions for canceling: Know how to end the insurance and what will happen if you do.

The Fine Print Has the Details

The fine print may provide important information about your insurance.

Carefully read: Carefully read all of the terms, conditions, and information.

Ask for further information: Ask the provider to clarify it to you if you don’t get it.

Getting advice from a professional

Getting counsel from an expert could help you make a better decision.

Insurance Agents and Brokers

Insurance agents and brokers may provide you specific information and help you look at other options.

Independent Brokers: Choose brokers that aren’t tied to a single provider and may give you a variety of options.

Licensed Agents: Before you speak to a broker or agent, be sure they are licensed and have a good reputation.

Money Advice

Financial advisors can help you see how insurance fits into your overall financial plan.

Find specialists that can assist you with all of your financial requirements, such as insurance.

Groups that aid people

Consumer advocacy groups can provide you information and support that isn’t biased.

Research groups: Find groups that assess and review insurance firms.

Consumer magazines: Look for magazines that compare different kinds of insurance.

Making a Good Decision

You have all the knowledge you need now, so it’s time to make a good decision.

Getting the correct amount of coverage for the right price

Find a decent balance between coverage and cost that fits your needs and your budget.

Weigh the costs and benefits: What do you get for the price of the premium?

Affordability: Make sure the insurance won’t cost you too much in the long run.

Trusting Your Gut

Sometimes, it’s important to trust your gut emotions.

Comfort Level: Choose a supplier who you trust and are comfortable with.

Customer Experience: When you were performing your research, think about how you spoke to the provider.

Deciding What to Do

Buy the insurance and finalize your selection after you’ve made up your decision.

Look at the information again: Before you sign, double-check that everything is correct.

Keep track of things: Keep a copy of your policy documents and any correspondence you send to the provider.

Questions that are often asked

1. How can I know whether an insurance business is honest?

Check out customer reviews and ratings online, as well as financial ratings from organizations like A.M. Best.

2. What should I look for in a policy?

Look for complete coverage, easy-to-understand terms and conditions, and any special benefits or discounts.

3. How can I be sure I’m getting the best bargain on my insurance?

Get quotes from a number of businesses and see if you can get a discount by combining insurance or loyalty programs.

4. What do I do if I’m not happy with the insurance provider I have now?

Check out other providers, see what they have to offer, and consider about switching if you find a better one.

5. Should you ask a broker or agent for help?

Yes, brokers and agents may provide you helpful information and help you compare several plans to choose the one that works best for you.

To sum up

Before picking an insurance company, you should think carefully about what you need, conduct a lot of research, and compare a number of various firms. If you know what to look for and ask for guidance from an expert when you need it, you can make an informed decision that offers you the best coverage for your circumstances.