- A complete guide to choose the best health insurance plan by comparing various ones

Picking the correct health insurance plan may be hard. There are a lot of choices, so it’s crucial to know what to look for to get the finest one. People may make smart choices that fulfill their health care requirements if they know the most important details regarding coverage and pricing.

When evaluating health insurance plans, rates, deductibles, and network coverage are all extremely important. If you know what your health needs are and how frequently you require medical treatment, it could help you compare. Knowing what advantages are covered, including as preventative care, might help you make better choices.

Knowing these things could help you make better decisions and speed up the process. Choosing the correct plan is a highly personal choice since everyone’s health care needs are different.

Important Things

Health insurance programs cover various things and cost varying amounts.

Some important things to think about include rates, deductibles, and network possibilities.

You should choose a plan based on what your health requirements are.

How to Understand Your Health InsuranceThere are several kinds of health insurance policies, and they all cover important words. These statistics could help consumers choose the correct insurance.

Different kinds of health insurance plans

There are many various kinds of health insurance policies you may choose from. Some frequent choices are:

People who join up for Health Maintenance Organizations (HMOs) have to choose a primary care doctor. You need a reference to consult a specialist. They usually offer cheaper premiums and out-of-pocket expenditures, but they aren’t as flexible.

Preferred Provider Organizations (PPOs) provide you additional choices. Members may visit any doctor, but they pay less if they see a doctor in the network. You don’t need a referral to see a specialist.

An Exclusive Provider Organization (EPO) is a kind of health insurance that has certain things in common with both HMOs and PPOs. They want customers to utilize a network of providers, but they don’t need to receive proposals.The pricing, quality of coverage, and number of providers you may pick from are different for each plan.

Important Terms in Health Insurance

To understand health insurance, you need to grasp a few basic terms:

The premium is the amount you pay each month for your coverage.

Deductible: The amount of money a member has to pay before the insurance begins to pay for things.

Copayment: A predetermined amount that members pay for certain services, including going to the doctor.

Out of Pocket Maximum: This is the most a member may pay in one year. From from point on, insurance will cover all charges.You will understand how insurance works if you know these words.

What is and isn’t covered

Different health insurance policies cover different things. Most plans include:

Regular exams, testing, and immunizations are all part of preventive care.

Hospitalization: The expenses of getting care in a hospital.

Prescription drugs: Most plans cover a selection of drugs, although the details of the coverage vary.On the other hand, exclusions normally do not include:

You don’t have to undertake cosmetic surgery to be healthy; it’s something you do to look better.

Experimental therapies are innovative medicines that not a lot of people have tried yet.Members may be able to better control their spending if they know what is and isn’t covered.

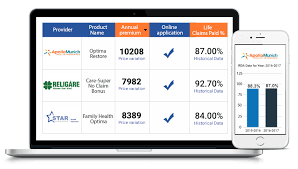

Looking at and comparing various health insurance programs

When picking a health insurance plan, there are a few important things to think about. Members should think about the pricing, the numerous providers they may pick from, the prescription coverage, and other perks. You will be able to make a decent decision if you know these things.

costs for premiums versus charges that you have to pay yourself

Your health insurance premiums are the monthly payments you make. Plans might contain a lot of different ones. Having reduced premiums may seem like a good idea, but they might mean you have to pay more out of pocket when you need treatment.

You have to pay for things like deductibles, co-pays, and co-insurance out of your own cash. Before your insurance begins to pay for items, you have to pay a deductible. Co-pays are set amounts for services, whereas co-insurance is the proportion of expenses that both parties cover when the deductible is reached. To choose a plan that meets your budget, you need to think about both the premiums and the costs you may have to pay out of cash.

Providers’ Networks and Facilities

Most health insurance companies provide you a list of physicians and hospitals that they think are good. The insurance firm has made deals with these hospitals, physicians, and specialists. Staying in-network is usually cheaper.

Prices may go up much more when you go outside the network. Many plans have various kinds of networks, such as HMOs and PPOs. Members of an HMO must see a primary care doctor and acquire recommendations. With a PPO, you may pick your providers more freely, but they usually cost more. You need to know how these networks operate if you want to get the care you need quickly.

Insurance for Medications

There are numerous ways that health insurance plans pay for prescription drugs. A formulary is a list of pharmaceuticals that are covered by certain insurance. This might change how much money you have to pay. Generic medications usually cost less than brand-name pharmaceuticals.

Members should check the formulary to make sure that their medications are covered. The tier in the formulary may also change how much you have to pay for your drugs. Plans frequently put pharmaceuticals into multiple levels, which modifies how much people have to pay for each prescription. You need to know these prices so you can make a sensible budget for your health care spending.

More Services and Benefits

Many health insurance policies cover more than just essential medical care. These might include wellness programs, telemedicine choices, and other services that help you remain healthy. Some plans provide you a discount on fitness courses or gym memberships.

These extra services could make a member’s health and wellness experience even better. People should think about these extras when comparing plans since they might have a big effect on their long-term happiness and health. You may be able to pick a comprehensive plan that helps you reach your health objectives by looking at both the main advantages and the extra services.

Also check out:

Some helpful insurance suggestions for first-time house buyers

The Good Things About Umbrella Insurance

How to Pick the Best Life Insurance Plan

Should you purchase pet insurance?

The Best Way to Pick the Right Insurance